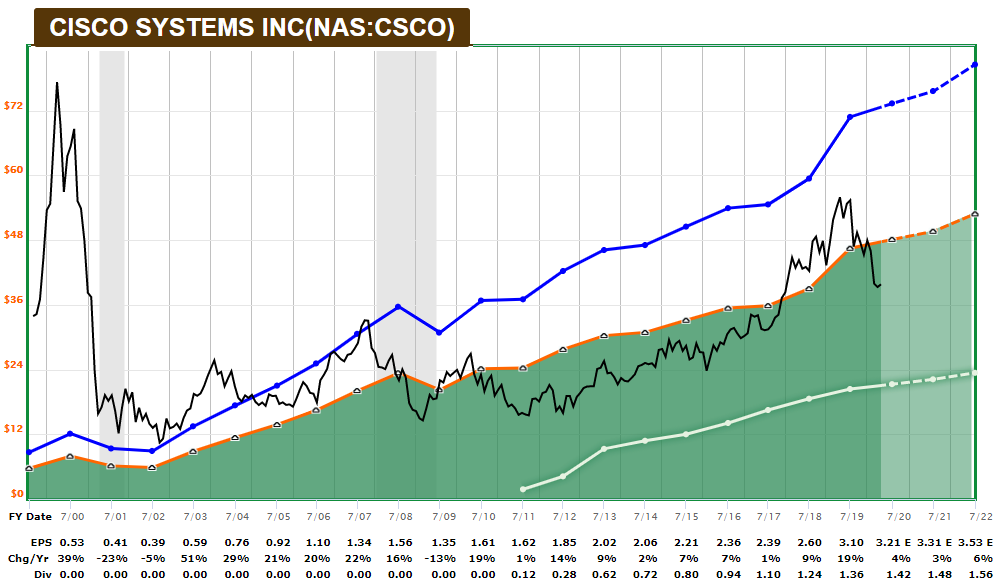

This chart shows 10-year Treasury yields in red compared to the cyclically-adjusted price/earnings ratio of the S&P 500 in blue: We can list some of the primary policies that fueled this effect.Īfter a very inflationary period in the 1970s, the US and the rest of the developed world have been in a four-decade trend of declining treasury rates. Instead, the increase in stock prices are primarily due to higher domestic corporate earnings and especially from higher valuations on those earnings, rather than international expansion.

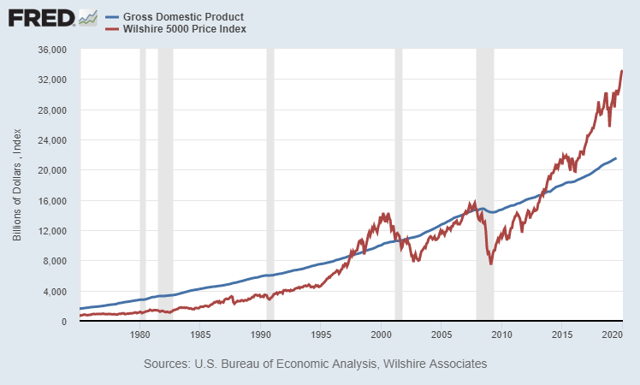

So, it’s not as though the US market simply became more global during that time. However, the opposite is true US companies have a slightly lower percentage of their revenue coming from outside the US today when the market capitalization is 200% of GDP, than they did ten years ago when the market capitalization was 90% of GDP. Some people assume that this increase in market capitalization to GDP is just because companies are selling more products like iPhones abroad. That doesn’t mean GDP itself goes down by 50%, but it means that a massive amount of purchasing power relative to the size of the economy would go away if even that type of moderate price decline were to occur and remain down for a while. If the stock market falls by one quarter, it would evaporate an amount of net worth that is equal to about half of the country’s GDP. As a result, the “tail can wag the dog”, meaning that a drop in the stock market can negatively affect consumer spending, economic growth, and foreign investment to a greater extent for the US than other developed countries.įor example, public US equities now represent about 200% of US GDP, which is an all-time high: This also means, however, that the US economy is more reliant on consumer spending and external financing than most other developed countries. Compared to other developed nations, the US has favored its corporate sector above most else since the early 1980s, which made the US stock market an attractive sponge to absorb capital from everywhere.Īs a result, the US stock market capitalization currently represents 61% of the global stock market capitalization, despite the fact that US GDP is only 23% of global GDP.

This naturally had some pros and cons associated with it.Įach country generally has a set of political priorities, and those priorities can change over time. The United States put in place a set of policies over the past four decades that pulled a lot of domestic and global capital into its stock market. This newsletter issue takes a look at the self-reinforcing cycle that stuffed excess global capital into the US stock market over the past 40 years (and especially the past decade) like a sponge soaking up water, along with an examination of catalysts that could cause this cycle to reverse.

17, 2022 6:20 AM ET AAPL, CDNS, COST, DIS, K, KO, MSFT, NKE, NVDA, PG, SPY, TLT, TSLA, TXN, ACTV, AFMC, AFSM, AMER, ARKK, AVUV, BAPR, BAUG, BBMC, BBSC, BFOR, BFTR, BJUL, BJUN, BKMC, BKSE, BMAR, BMAY, BOCT, BOSS, BOUT, BUFF, BUL, CALF, CATH, CBSE, CSA, CSB, CSD, CSF, CSML, CSTNL, CWS, CZA, DDIV, DEEP, DES, DEUS, DFAS, DFAT, DGRS, DIA, DIV, DJD, DMRL, DMRM, DMRS, DON, DSPC, DVLU, DWAS, DWMC, EES, EFIV, EPS, EQAL, ESML, ETHO, EWMC, EWSC, EZM, FAB, FAD, FDM, FFTY, FLQM, FLQS, FNDA, FNK, FNX, FNY, FOVL, FRTY, FSMD, FTA, FYC, FYT, FYX, GBGR, GLRY, GSSC, HAIL, HIBL, HIBS, HLGE, HOMZ, HSMV, IJH, IJJ, IJK, IJR, IJS, IJT, IMCB, IMCG, IMCV, IPO, ISCB, ISCG, ISCV, ISMD, IUSS, IVDG, IVE, IVOG, IVOO, IVOV, IVV, IVW, IWC, IWM, IWN, IWO, IWP, IWR, IWS, IYY, JDIV, JHMM, JHSC, JPME, JPSE, JSMD, JSML, KAPR, KJAN, KJUL, KNG, KOMP, KSCD, LSAT, MDY, MDYG, MDYV, MGMT, MID, MIDE, MIDF, NAPR, NIFE, NJAN, NOBL, NUMG, NUMV, NUSC, NVQ, OMFS, ONEO, ONEQ, ONEV, ONEY, OSCV, OUSM, OVS, PAMC, PAPR, PAUG, PBP, PBSM, PEXL, PEY, PJAN, PJUN, PLTL, PQLC, PQSG, PQSV, PRFZ, PSC, PTMC, PUTW, PWC, PY, QDIV, QMOM, QQC, QQD, QQEW, QQQ, QQQA, QQQE, QQQJ, QQQM, QQQN, QQXT, QTEC 362 Comments 445 Likes

0 kommentar(er)

0 kommentar(er)